Will be no increase in taxes for the middle class is not.After markets closed monday in ottawa.

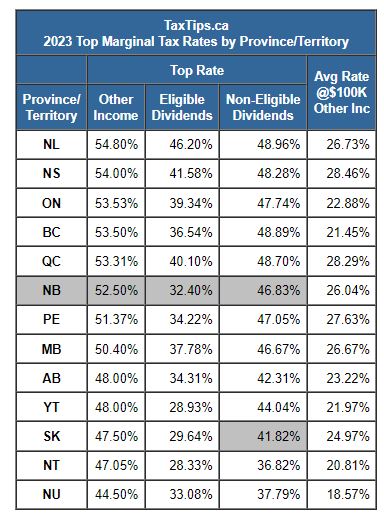

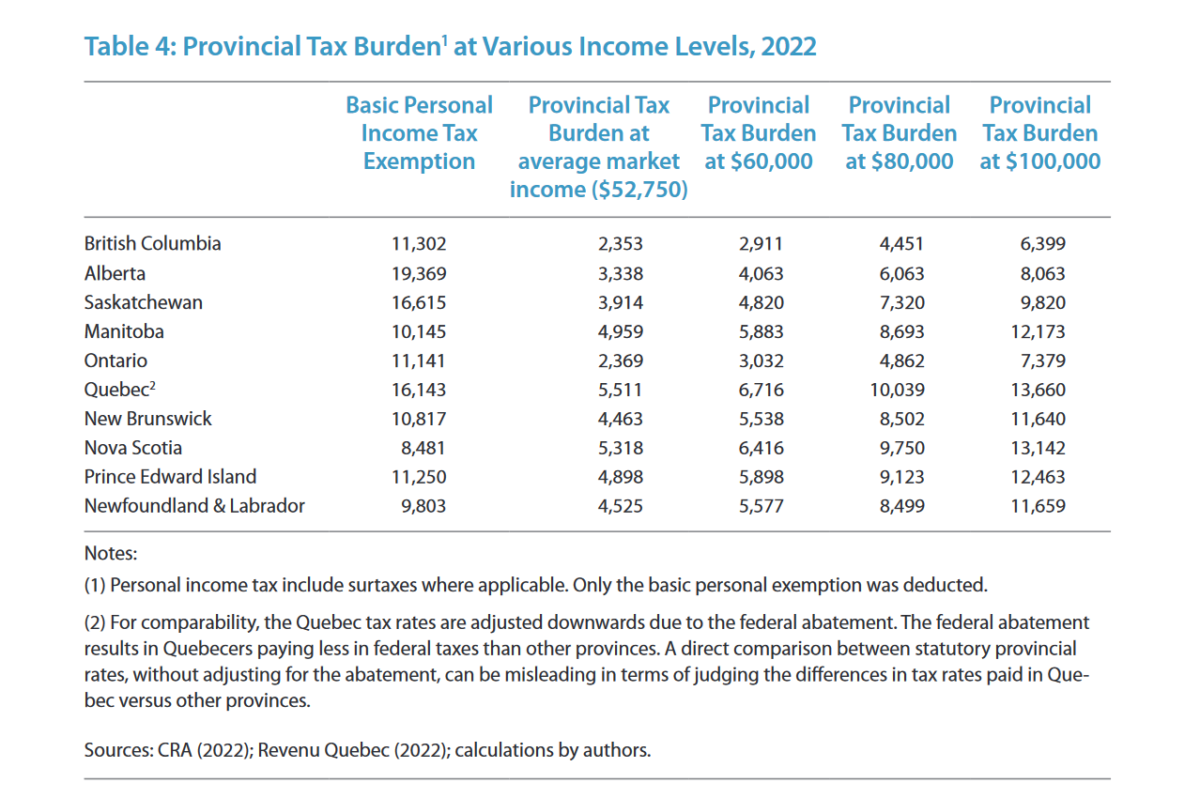

Consequently, the elimination of these tax credits resulted in higher personal income taxes.This income bracket corresponds to earning between 75% and 200% of the median household income after tax.Speaker, to responsibly build a fairer future for younger canadians, we need to make sure our tax system is more fair.

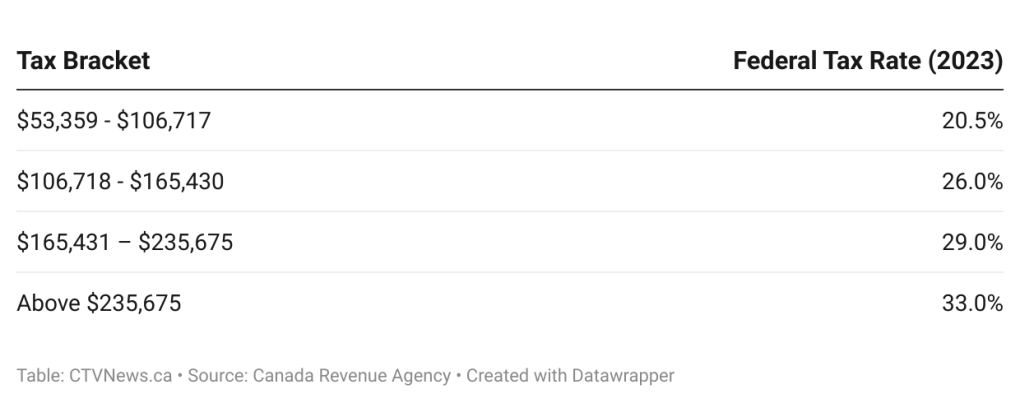

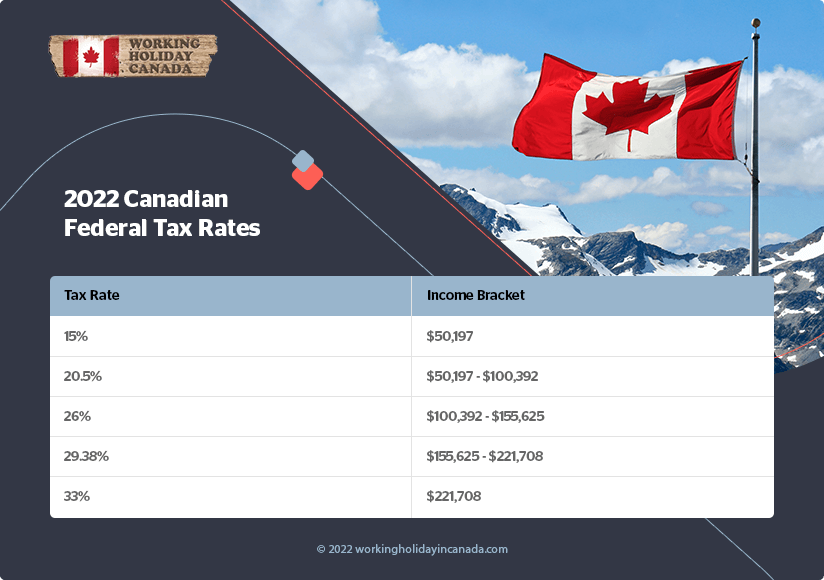

In 2024, the first $55,867 would be taxed at 15 per cent.Middle class canadians will continue to benefit from the.

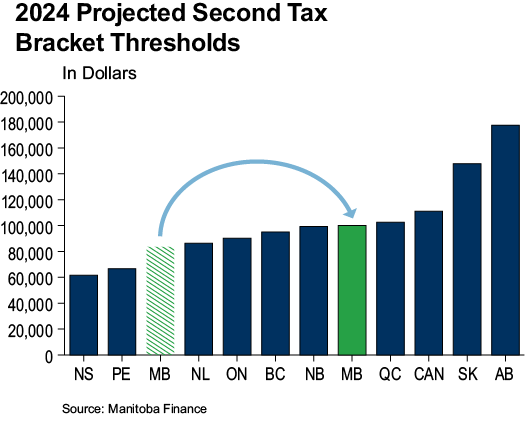

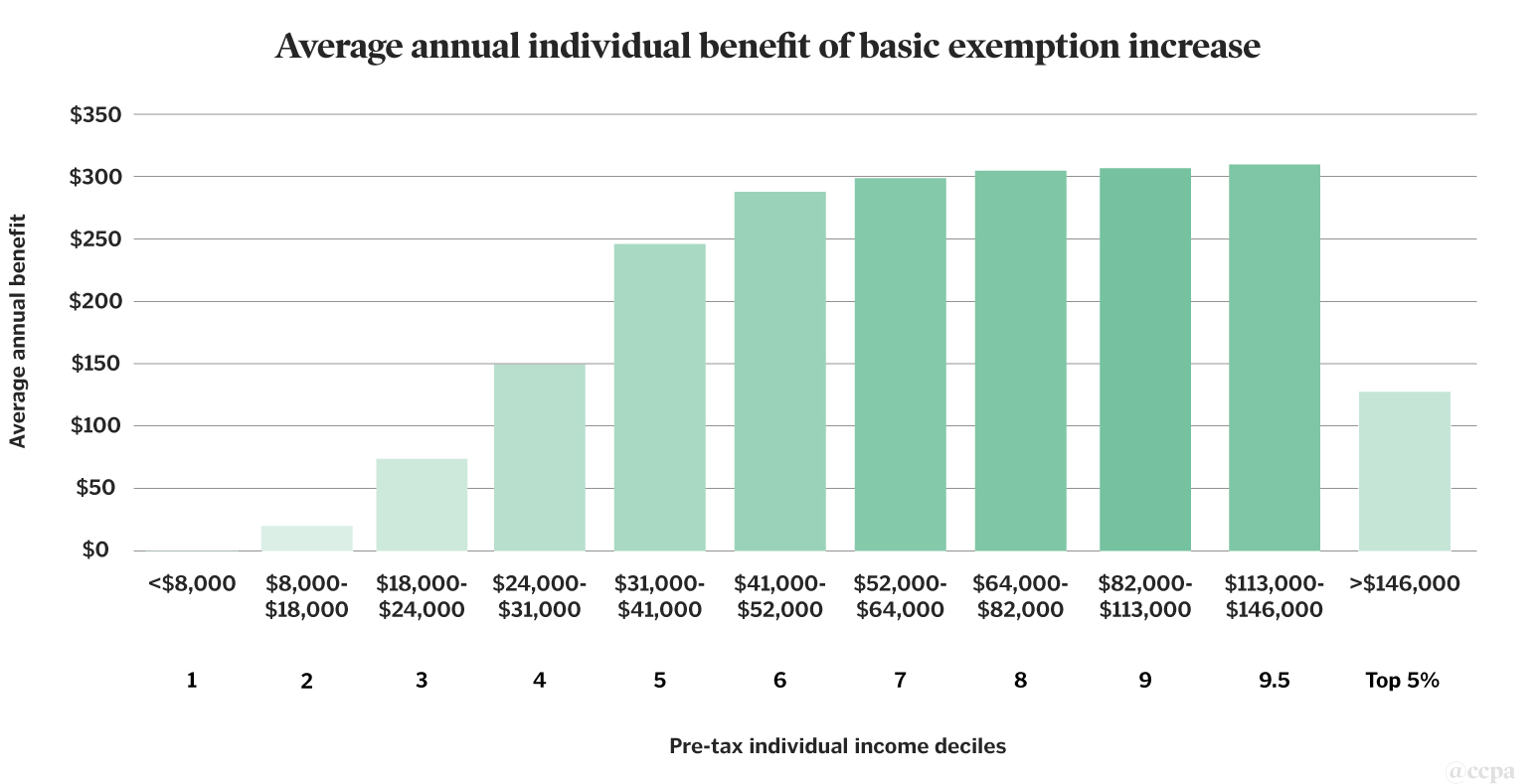

If you file on paper, you should receive your income tax package in the mail by this date.Lowering taxes on the middle class by cutting the second income tax bracket rate and by increasing the basic personal amount, to save more than 20 million middle class canadians more than $450 on average in 2024.2024 federal income tax rates.

Be taxable under new rules introduced in the 2024 federal.And the party fulfilled it shortly after taking office by dropping the tax rate on earnings between $45,282 and.

Last update images today Middle Class Tax Canada

Johnny Grave: West Indies' Covid Tour Showed Big Three Need Strong Opponents

Johnny Grave: West Indies' Covid Tour Showed Big Three Need Strong Opponents

WIMBLEDON, England -- French Open runner-up Jasmine Paolini reached her first Wimbledon quarterfinal when Madison Keys had to retire with a leg injury at 5-5 in the third set of their fourth-round match Sunday.

Keys had served for the match at 5-2 in the last set but then started limping more and more and needed a medical timeout to get her left leg worked on after Paolini made it 5-4. She had her left thigh taped as she served for the match for a second time but was broken again -- double-faulting on break point -- and was in tears by the end of that game, with her movement clearly restricted.

Keys tried to play on, but the American finally went to the net to tell the chair umpire on No. 1 Court that she was retiring after Paolini hit an ace for 15-15 in the final game.

The Italian had won the first set 6-3 before Keys won the second 7-6 (6).

Keys had been two points from the win when the score was deuce at 5-2.

"I'm so sorry for her. To end the match like this, it's bad," Paolini said in her on-court interview. "What can I say? We played a really good match. It was really tough. A lot of ups and downs. I'm feeling a little bit happy, but also sad for her. It's not easy to win like that."

Paolini is the fifth Italian woman to reach the Wimbledon quarterfinals in the professional era and will try to become the first to make the semifinals. She will face the winner of the match between No. 2 Coco Gauff and 19th-seeded Emma Navarro later on Centre Court.

Keys was trying to reach the last eight for the second year in a row at the All England Club and third time overall.

Donna Vekic advanced after beating Paula Badosa 6-2, 1-6, 6-4 in a stop-start match on No. 2 Court that was interrupted several times because of rain. Vekic will be playing in her first Wimbledon quarterfinal, in her 10th appearance at the grass-court Grand Slam tournament.

-1625833913635.png)

:format(jpeg)/cloudfront-us-east-1.images.arcpublishing.com/tgam/3BXFWHM5KJBZBOOP2YOTTLZUJ4.jpg)