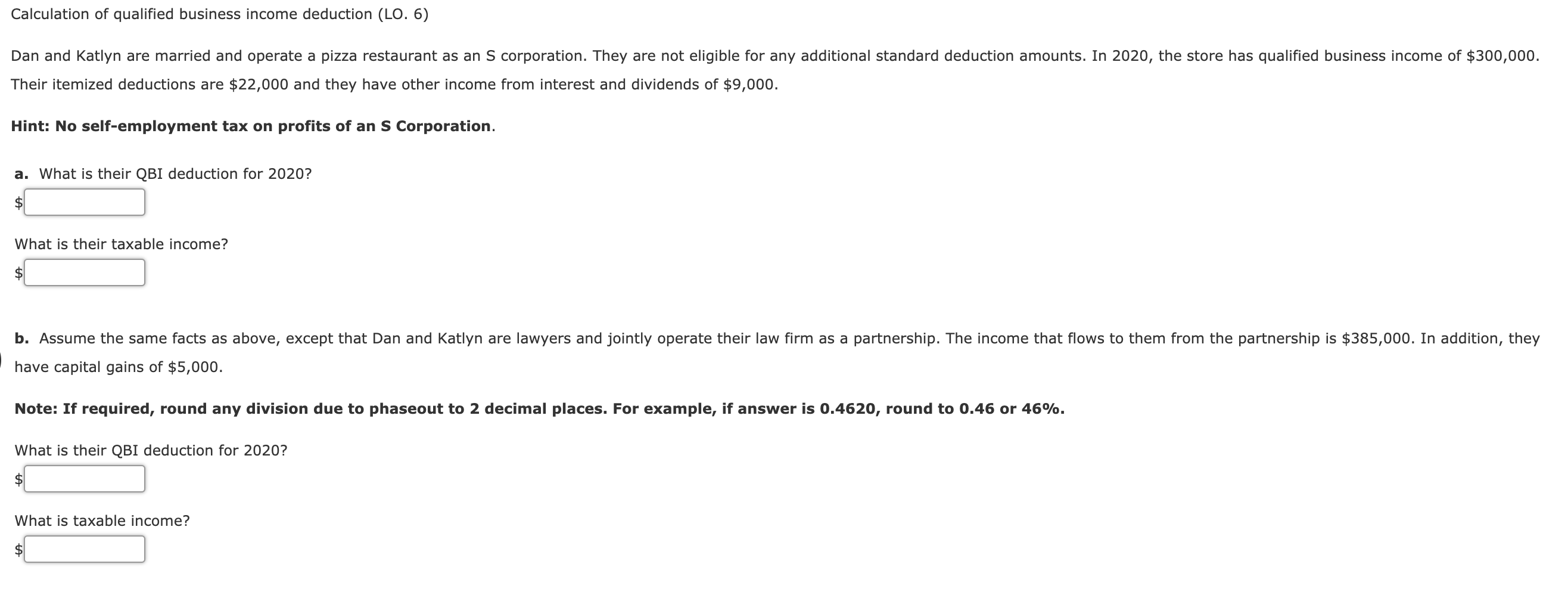

The qbi deduction is the lesser of 1 or 2, below:The deduction is limited to 20% of taxable income.

How to calculate a qualified business income deduction.This is the same type of income that you report on your schedule c during tax season.Jul 15, 2021 • 4 min read.

Tax tips for small business owner;With this deduction, select domestic businesses can deduct roughly 20% of their qbi, along with 20% of their publicly traded partnership income (ptp) and real estate investment trust (reit) income.

25 percent of those wages, plus 2.5 percent of your share of qualified propertyBut this deduction isn't for everyone.The qualified business income deduction (qbi) is intended to reduce the tax rate on qualified business income to a rate that is closer to the new corporate tax rate.

20% of the taxpayer's qbi, plus 20% of the taxpayer's reit dividends and ptp income, or.In order to qualify for a deduction, you must have taxable income below a certain threshold.

This worksheet is designed for tax professionals to evaluate the type of legal entity a business should consider, including the application of the qualified business income (qbi) deduction.

Last update images today Qualified Business Income Calculator

Julio Rodríguez Homers, J.P. Crawford Drives In Three And Mariners Beat Orioles 7-3 To Avoid Sweep

Julio Rodríguez Homers, J.P. Crawford Drives In Three And Mariners Beat Orioles 7-3 To Avoid Sweep

LONDON -- Novak Djokovic, Rafael Nadal and Andy Murray all were included on the entry list for tennis at the Paris Olympics released by the International Tennis Federation on Thursday, as was Daniil Medvedev, who will be competing as a neutral athlete rather than representing Russia because of that country's ongoing war in Ukraine.

Djokovic (Serbia) and Murray (Britain) are both 37 and Nadal (Spain) is 38, and all own multiple Grand Slam titles. Djokovic holds a men's-record 24 major trophies, but he has never won a gold medal at the Olympics.

Nadal, next on the men's Slam list with 22, won golds in singles in 2008 and doubles in 2016. He skipped Wimbledon, which is currently being played, to prepare for the Olympics.

Murray won three major championships and is the only tennis player with consecutive singles gold medals at the Summer Games. He has said he plans to retire after the Paris Olympics, which will hold tennis matches from July 27 to Aug. 4 on the clay courts at Roland Garros, the site of the French Open -- where Nadal is a 14-time champ.

The leading women on the entry list are No. 1 Iga Swiatek (Poland), No. 2 Coco Gauff (United States) and No. 4 Elena Rybakina (Kazakhstan). No. 3 Aryna Sabalenka decided not to go to the Olympics; her nation, Belarus, aided Russia in its invasion of Ukraine, so she would have competed as a neutral athlete like Medvedev.

Swiatek is a five-time Grand Slam champion -- including at the French Open in four of the past five years -- and Gauff and Rybakina have won one major apiece. Gauff made the U.S. team for the Tokyo Games three years ago, but she did not go because she tested positive for COVID-19.

There are 64-player draws for women's and men's singles and 32 teams each in women's and men's doubles. The 16 entries for mixed doubles will be determined July 24. The draw to determine the brackets will be in Paris on July 25.

Among the other players announced Thursday are three-time major champion Carlos Alcaraz -- who will play doubles alongside Nadal for Spain -- No. 1 Jannik Sinner (Italy), Tokyo Olympics gold medalist Alexander Zverev (Germany), 2008 doubles gold medalist Stan Wawrinka (Switzerland), four-time Grand Slam winner Naomi Osaka (Japan), 2019 US Open champion Bianca Andreescu (Canada) and 2018 Australian Open champion Caroline Wozniacki (Denmark).

Osaka lit the cauldron at the Tokyo Olympics.

Lebanon will make its debut in Olympic tennis, with Benjamin Hassan entered in singles and also partnering with Hady Habib in doubles.