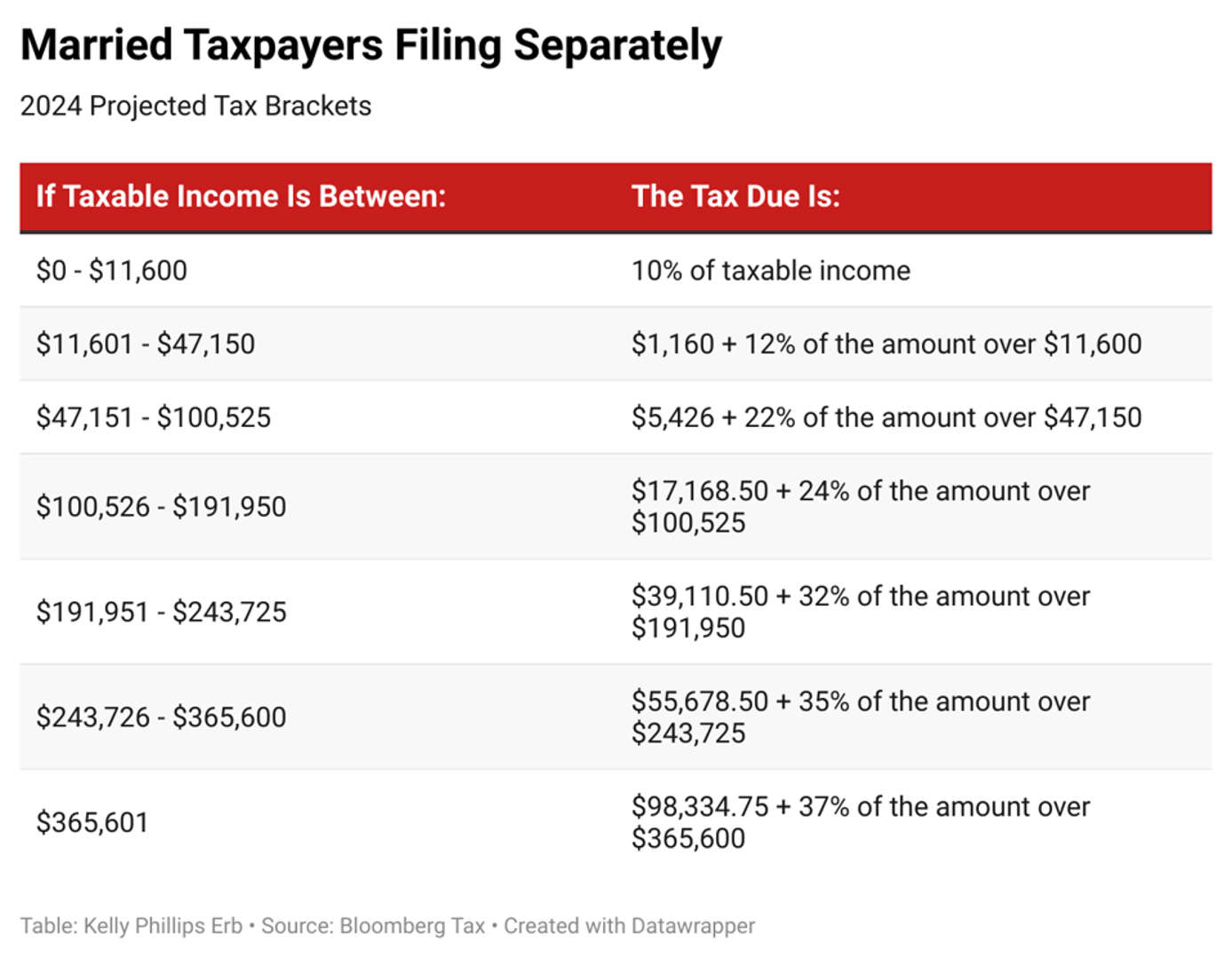

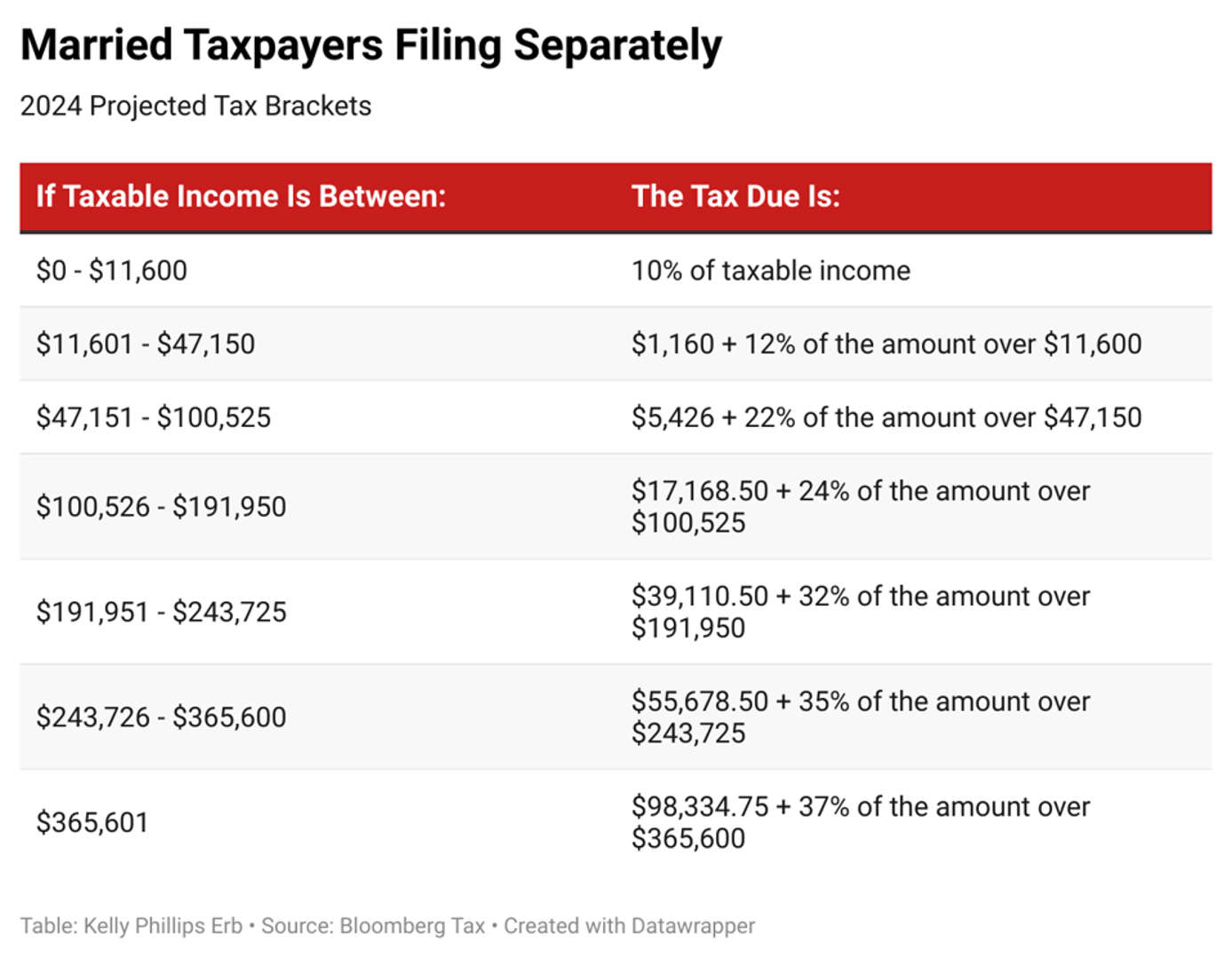

I currently make about $45,750.00 gross a year.35% for incomes over $487,450.

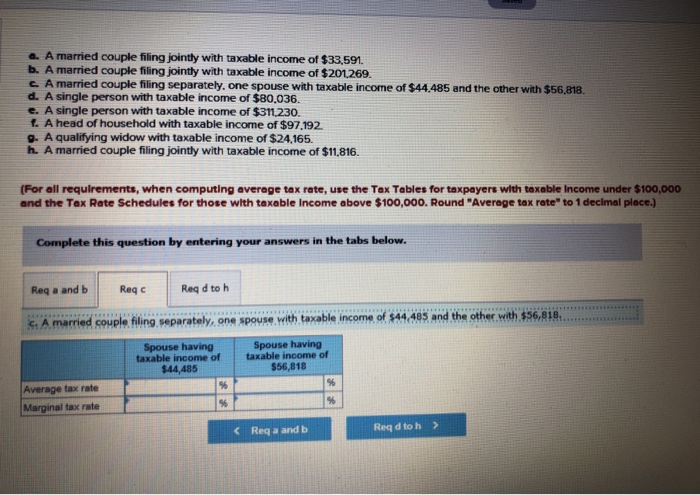

When your income is $146,000 to $160,999 :Think prenuptial agreements, privately held companies, trusts, etc.For most couples, filing jointly is normally better.

As another example, single filers can deduct up to $3,000 of capital gains losses from income.Your eligibility to file jointly is based on your marital status on the.

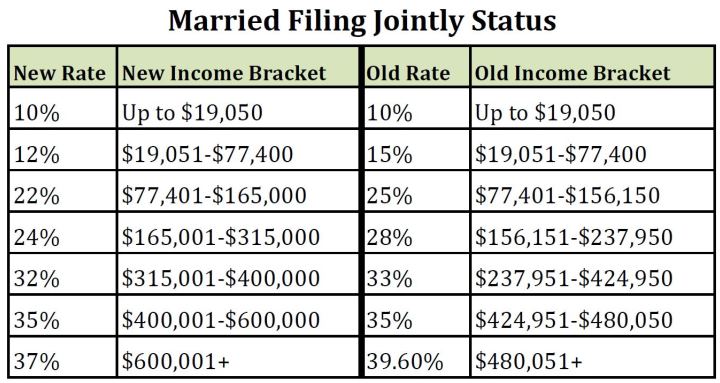

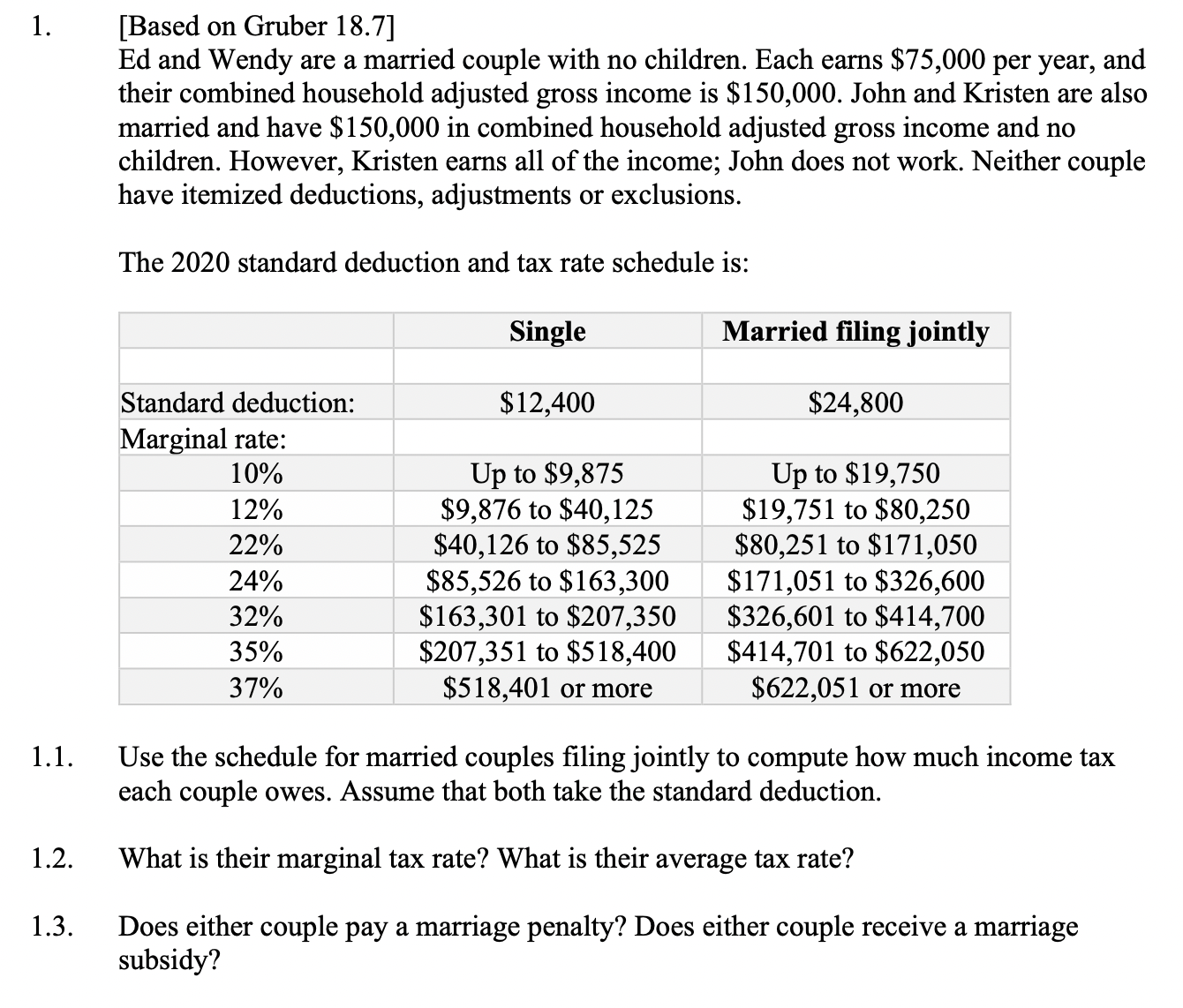

That isn't always the case though.This year, the standard deduction for couples married filing jointly is up to $27,700, up $1,800 from last year.Married couples filing jointly are taxed at the 10% rate on their first.

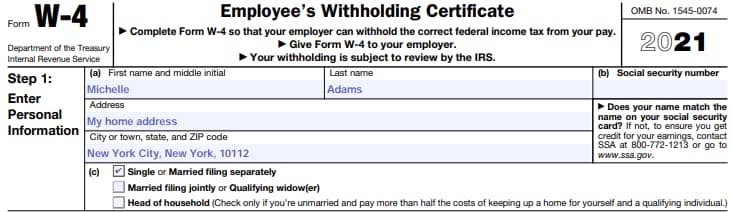

Deciding which filing status to choose can significantly impact your tax liability and potential refunds.12% on the remaining $58,000.

Joint filing may be the best option if both spouses have similar incomes.Tax brackets 2024 married jointly over 65 elyse imogene, the married filing separately tax status is, in most cases, less favorable than filing single, married filing jointly, or head of household.Those filing jointly are also eligible for a larger standard deduction amount, which when combined with the above credits could equal a better tax benefit.

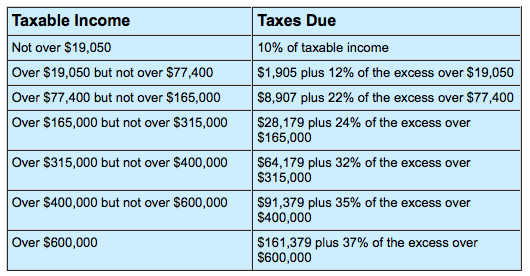

Marginal tax rates for married couples filing jointly were:You can file a joint return even if one of you had no income or deductions.

The standard deduction for taxpayers younger than age 65, currently $14,600 (single) and $29,200 (married filing jointly), is expected to decline to $8,300 and $16,600, respectively, according to.If you filed your taxes jointly on the $80,000 you made, your tax rates would be:

Last update images today Should I File Married Jointly Or Separately

Defensive Back Johnson III Agrees With Rams

Defensive Back Johnson III Agrees With Rams

Outside linebacker LaVar Arrington II, the son of former Penn State All-American and seven-year NFL veteran LaVar Arrington, announced his commitment to the Nittany Lions on Thursday.

Arrington II hails from Covina, California, and is a two-way standout at Charter Oak High School where he totaled 65 tackles and 12 sacks during his junior season last fall. The 6-foot-2, 210-pound defender held offers from the likes of Michigan, Washington and Colorado, and commits to his father's alma mater following spring visits to Penn State, Tennessee and UCLA.

The elder Arrington authored a career worthy of the College Football Hall of Fame with the Nittany Lions from 1997-99, where he emerged as one the nation's fiercest linebackers and became known for the "LaVar Leap." Arrington tallied 173 total tackles, 19 sacks and 3 interceptions on the way to back-to-back All-America selections, including unanimous honors in the 1999 season. That same year, Arrington took home the Butkus and Bednarik Awards, along with the Jack Lambert Trophy, while finishing ninth in Heisman Trophy voting.

Arrington was later selected by the Washington Redskins with the No. 2 pick in the 2000 NFL Draft and earned three Pro Bowl selections across seven seasons in the pros. In retirement, Arrington has launched a successful media career with footholds in television and radio.

With his pledge, Arrington II becomes the 21st member of James Franklin's 2025 class at Penn State, a group headlined by 10 ESPN prospects including Mater Dei cornerback Daryus Dixson, No. 90 in the 2025 ESPN 300. The Nittany Lions' incoming class ranks eighth in ESPN national team rankings for the 2025 class.

/https://blogs-images.forbes.com/learnvest/files/2015/03/531887071-1940x1295.jpg)